|

|

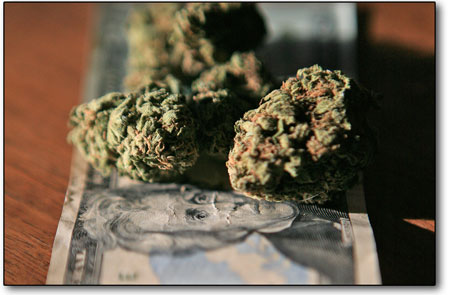

Currently, 20 states have legalized medical marijuana and two, Colorado and Washington, also have legalized recreational use. Regardless of state law, it is still considered illegal under federal law. Because of this, many banks are leery of prosecution for doing business with marijuana retailers, despite a recent Department of Justice memo to the contrary. Many say the wording of the memo does not go far enough to protect banks and businesses./Photo Illustration by Steve Eginoire. |

Not banking on it

Banks, marijuana businesses still hazy on latest DOJ directive

Easy being green: State rakes in $2m in first month of pot sales tax

by Tracy Chamberlin

The buzz was everywhere after he even hinted at it.

Suggesting that a cash-only business, like those in the medical or retail marijuana industries, was a public safety concern, U.S. Attorney General Eric Holder alluded at an appearance at the University of Virginia in January that he would address the concern.

A few weeks later, word came down from Washington in the form of two memos that banks would be able to do business with marijuana companies. But after reading all the fine print, not everyone is convinced.

“It really doesn’t amount to anything at all,” said Joelle Riddle, manager of Medical Horticultural Services in Durango and a former La Plata County commissioner.

Riddle said not everyone, including banks and businesses, understands the details of the announcement.

When she first heard about it, she thought she might have a green light to go banking in Durango, but after carefully going over the documents, she realized that wasn’t the case.

The two memos, one released from the U.S. Department of Justice and another from the U.S. Treasury Department, offer priorities and guidelines, not law and order.

The Department of Justice notice echoed an August 2013 document, referred to as the Cole Memo, outlining eight specific “priorities” for federal prosecutors. Activities such as selling marijuana to minors or funneling monies to drug cartels would be the focus of the DOJ, not medical or retail businesses operating in compliance with state law.

The companion memo – released by an enforcement arm of the Treasury called the Financial Crimes Enforcement Network or FinCEN – laid out guidelines for how banks could conduct business with the marijuana industry.

“Now that some states have elected to legalize and regulate the marijuana trade, FinCEN seeks to move from the shadows the historically covert financial operations of marijuana businesses,” FinCEN Director Jennifer Shasky Calvery said in a press release. “Our guidance provides financial institutions with clarity on what they must do if they are going to provide financial services to marijuana businesses … .”

But clarity is not what the document provides, according to Sean McAllister, a dispensary attorney in Denver.

He said the FinCEN memo doesn’t provide any protection. In fact, it might make the situation worse since anyone doing business with medical or retail marijuana businesses is at risk as long as it remains illegal under the Controlled Substances Act.

In other words, banking is not the real issue. It’s federal law. “In reality, the entire industry is violating federal law,” McAllister said.

Currently, 20 states have legalized medical marijuana and two, Colorado and Washington, have legalized recreational use.

Regardless of those state laws, marijuana is still considered illegal under the CSA and a financial institution could be subject to investigation or prosecution if it conducts business with a marijuana-related company.

Unfortunately, this means many banks won’t open their doors, leaving some in the industry to operate on a cash-only basis.

That doesn’t mean no one is doing business with marijuana-related companies. According to McAllister, about 50 percent of marijuana businesses already have bank accounts. Banks want their business 4 and trust them.

But it is the bank’s choice.

The FinCEN memo specifically leaves the decision to open an account or have a relationship with a marijuana-related business up to individual financial institutions.

“They’re choosing not to do business with us,” Riddle said.

And it doesn’t just leave the decision of whether or not to do business up to the banks, it also charges them with figuring out who might be violating the DOJ’s eight priorities.

“As part of its customer due diligence, a financial institution should consider whether a marijuana-related business implicates one of the Cole Memo priorities or violates state law,” the memo reads.

“This is a particularly important factor for a financial institution to consider when assessing the risk of providing financial services to a marijuana-related business.”

The memo reviews the details of filing Suspicious Activity Reports, official documents considered “highly useful in criminal investigations and proceedings,” as well as other banking requirements. It even lays out red flags that could indicate whether or not a customer is violating one of the Cole Memo priorities.

McAllister said he doesn’t understand the purpose of the memo, adding that perhaps it’s political. After all, the fact remains that without concrete protections in place, banks and marijuana-related companies remain at risk.

For him, the concern isn’t a sudden 180-degree turn when the next president moves into the White House. McAllister doesn’t believe a different president would suddenly prosecute banks and businesses involved with the marijuana industry.

“I think that’s an unjustified concern,” he said. “… I think the politics of it make it highly unlikely.”

Instead the unease is with the current administration. With memos making suggestions and offering guidelines rather than concrete laws, federal prosecutors are free to pick and choose who, where, why and how. And, they can choose to prosecute at any time.

“They still have total discretion,” McAllister said.

The only way to truly offer protection for banks and marijuana-related businesses is through an executive order by the president, formal regulation or a statute passed by the U.S. Congress.

Riddle said she is trying to be optimistic, calling the fact that the discussion is under way exciting and promising.

“It’s great that we’re getting there,” she said. “And, we are getting there.”