|

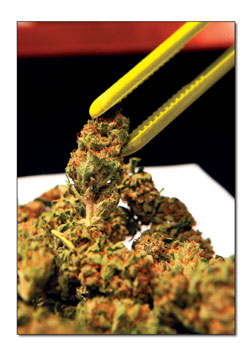

| Amendment 64 accounts for an excise tax capped at 15 percent; however, it leaves room for adding on a special sales tax. That’s where the Marijuana Products Sales Tax comes in, proposed at 15 percent. Add that to a maxed-out excise tax, plus local and state taxes, and the grand tax total of “adult-use” pot could be almost 38 percent./Photo by Steve Eginoire |

Sharper image

Guidelines for recreational marijuana industry come into focus

How much is too much: Determining the legal limit

by Tracy Chamberlin

After Colorado voters approved Amendment 64 in November, some residents celebrated. Others did not. One thing both supporters and opponents asked: What now?

After Colorado voters approved Amendment 64 in November, some residents celebrated. Others did not. One thing both supporters and opponents asked: What now?

And, it’s quite the to-do list that comes with a ticking clock. After all, the amendment intended to regulate marijuana like alcohol includes deadlines for implementation which start July 1. Intended to keep the ball rolling, it means that state lawmakers don’t have time to sit on their laurels.

Some of the questions that need answers include: What’s the tax on marijuana sales? What would be considered driving under the influence? Do sellers have to grow their own product? What would that packaging look like? And, is this going to be a cash-only business?

In an attempt to not get stuck in the weeds, Gov. John Hickenlooper put together a 24-member task force at the end of last year to identify the policy and procedural issues that come with this newly adopted industry.

The group produced a 165-page report at the end of February and, almost immediately, a Joint Select Committee made up of members from the state House of Representatives and Senate began using that report to craft legislation.

Led by Rep. Dan Pabon (D-Denver), the committee put together a host of recommendations over the past month with the final meeting Monday. And, they saved the biggest for last: production and tax talks came in the final two meetings.

First, they recommended a separation of growers and sellers. Currently, state law requires medical marijuana businesses to grow most of their own product, but taking that requirement out of the industry means businesses could specialize. They could just grow, sell or do both.

The other big reveal was the tax.

Amendment 64 accounts for an excise tax capped at 15 percent, as well as an application fee for a marijuana business license at $500; however, it leaves room for adding on a special sales tax or additional licensing fees. That’s where the committee came in with the Marijuana Products Sales Tax.

They proposed a rate of 15 percent. If the excise tax was maxed out at 15 percent and the committee’s additional product rate was applied, the total would add up to 30 percent.

Then there are local and state taxes. For example, Durango’s sales tax rate is 7.9 percent, which could increase the grand tax total to almost 38 percent.

It’s not that the state is just trying to make a buck. The amendment specifically earmarks the first $40 million in tax revenues each year for the public school capital construction assistance fund. The rest would go to help cover the costs of regulating the industry.

This is something that Durango underestimated and had to adjust later on. The city increased the fees for medical marijuana businesses last year after realizing they weren’t taking in enough to pay for regulation.

All that took was a vote by the City Council, but it wouldn’t be that simple at the state level. Under TABOR, the Colorado Taxpayer’s Bill of Rights, tax increases can only be approved by voters.

This is where it gets tricky. State lawmakers don’t need voter approval to lower the tax, only to increase it. If they aim too high on the tax rate, voters might not approve it. If they aim too low, they might be forced to come back to the voters to increase the rate. And, it’s still unknown if the tax would apply to medical marijuana patients or just adult-use customers.

Whatever the rate lawmakers recommend, it will go before Colorado voters this November. And the same voter pool that approved Amendment 64 last year, 55 percent for and 45 percent against, will make the decision.

Some of the other regulations discussed:

- First of all, it’s not called recreational marijuana use. It’s officially tagged the “adult-use marijuana industry.”

- Medical marijuana centers and adult-use marijuana stores would be allowed in one location, but only if they are completely separate entities.

- Limits would be set on how much marijuana can be sold in one transaction; and, how much can be sold to Colorado residents vs. visitors to the state.

- Product labels must include potency, safety instructions, batch numbers and a universal symbol that indicates that the product contains marijuana or is a marijuana-infused product.

- Limits or bans on marketing and advertising.

- The creation of a credit union for the industry. Something that has hindered medical marijuana businesses is their inability to get bank accounts due to the conflict between state and federal law, which in the past has forced them to operate as a cash-only business.

The report from the Governor’s Task Force and the subsequent recommendations from the joint committee are slowly but surely bringing the big picture into focus, but many local businesses are still waiting to see what the rules are before they can decide whether or not to get in the game.

“I feel like everyone’s waiting to see what the state does,” said David Niccum, general manager for Acme Healing Center in Durango.

Acme has two locations in Colorado: Crestted Butte and Durango, with a third planned for Ridgway.

Niccum is anticipating an influx of customers in January 2014 when adult-use marijuana businesses are allowed to open their doors. And, like other Durango marijuana business owners, Acme will go where the customers take them.

Whether that’s a growing customer base in medical marijuana, adult-use marijuana or both depends greatly on what state lawmakers decide to do over the next month.

The industry’s future depends on things like when they can start producing products, what the packaging of those products needs to look like, and what kind of tax system will they be working with.

In order to make the July 1 deadline for putting regulations in place, state lawmakers have until May 8 when they adjourn to pass specific bills. Until then, Niccum and other local businesses are playing the waiting game.

“We’re sitting on one side of the fence,” he said, “peeking over the other side.”

In this week's issue...

- May 15, 2025

- End of the trail

Despite tariff pause, Colorado bike company can’t hang on through supply chain chaos

- May 8, 2025

- Shared pain

Dismal trend highlights need to cut usage in Upper Basin, too

- April 24, 2025

- A tale of two bills

Nuclear gets all the hype, but optimizing infrastructure will have bigger impact