| ||

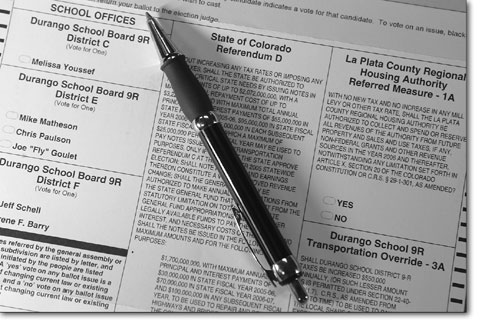

Demystifying the ballot

by Missy Votel There may be no election judges, ballot boxes or “I Voted” stickers associated with this year’s election by mail. But, despite the lack of the pomp and circumstance of the voting booth, there are still some important issues on this year’s ballot. In addition to naming three new seats to the Durango School District 9-R board, local voters will be faced with four other measures on their ballots: the hotly contested referenda C & D; a referred measure for the La Plata County Regional Housing Authority; and the Durango School District 9-R transportation override. The first three items are essentially de-Brucing measures, aimed at allowing government entities to keep excess tax revenues and skirt other provisions of the 1992 Taxpayers Bill of rights (TABOR); and the fourth is a self-explanatory tax increase to cover increases in the school district’s transportation expenses. So, without further adieu, here is a breakdown of the issues as well as the pros and cons associated with each. We’ve also included where the Telegraph falls on each, for those who may want to adjust their voting accordingly or just send us nasty mail. Referendum C What is proposes: To authorize the state to retain and spend all state revenues from existing taxes in excess of constitutional limitations for the next five years, allowing the state to keep an estimated $3.7 billion. The retained excess state revenues would be used for education, health care, transportation, and retirement plans for firefighters and police officers. Would allow for a temporary tax cut when revenues exceed the existing TABOR limits after the fifth year and set a new spending level for the state beginning in 2011. Background: Referendum C would correct the “ratcheting down” effect of TABOR, whereby the state’s General Fund Budget each year is adjusted according to the previous year’s plus 6 percent. Anything collected above and beyond this must be returned to taxpayers. However, this becomes problematic when the budget base declines, as it did during the recent recession period. As a result, the amount of money the state is allowed to keep each year diminishes. For example, say the past state budget was $100, adding 6 percent would bring the new base to $106. But, if only $90 is collected that year, the following year’s base would be $90 plus 6 percent, or $95.40. If the economy continues to decline, the budget base would be reduced in the same way, forcing further budget cuts. Even if the economy recovers, the base will stay at the lower level because TABOR does not allow it to be adjusted upward, and the surplus must be returned to the taxpayers. Thus, the state can never fully recover from an economic downturn. Pros: This proposal would allow Colorado to catch up from the recent recession without raising taxes. In the past few years, funding for higher education, road and building maintenance, and community-based health care was significantly reduced. Such cuts include: • $5.1 million, or a quarter of the budget, for mental health care • $4 million, or more than half of the budget, for youth crime prevention • $2.5 million, the entire budget, for affordable housing • $150 million, or one-fifth, of the higher education budget • $15 million in college financial aid • $20 million to fix dilapidated schools Referendum C would provide the necessary money to improve the state’s roads, bridges and schools; to deliver better health care for low-income, senior and disabled Coloradans; to support education; and to ensure that higher education remains affordable. These investments are critical to create and keep jobs, and to address the needs of a growing state. With money from Referendum C, Colorado could restore much of the funding for these critical needs. Referendum C does not change any constitutional provisions within TABOR; it maintains voters’ rights to approve future tax increases; it allows only a five-year timeout from budget limits; and it utilizes a TABOR provision that allows voters to approve the use of excess revenue. Proponents argue that Referendum C does not constitute a tax increase and does not change any existing income, sales or property tax at the state or local levels. In fact, Referendum C provides for a potential cut in state income taxes after five years. Those in favor include: Colorado League of Women Voters; Colorado Gov. Bill Owens; Rep. Mark Larson, R-Cortez; Sen. Jim Isgar, D-Hesperus; Durango School District 9-R; Fort Lewis College; and Durango City Council. Cons: Fiscal conservatives argue that Referendum C amounts to a tax increase because the state government will get to keep all the excess money that TABOR is meant to return to citizens. It also encourages fiscal irresponsibility and excessive government by handing over a blank check to the state. The estimated cost of Referendum C would be $3,200 per family of four, over the five-year period. Such a decrease could hurt private spending, thus dampening the economic recovery. Furthermore, because there is no way of knowing what revenues will be in the foreseeable future, the actual amount4 could be much higher. Also, the referendum could cause a “ratcheting-up effect” whereby once state spending has gone up, it will never go down because the highest level of spending will become the new baseline. Opponents also refute the argument of a state budget crisis, noting that the budget is at an all-time high. Those against include: Marc Holtzman, Republican candidate for governor; Freedom Works, a 700,000-member national group promoting small government. Where we stand: Although we enjoy tax refund checks as much as the next guy (the subject of tax refunds with Referendum C is still being debated) we feel it is impossible to squeeze water from a rock, or turnip, or whatever the cliché is. The point is, if Referendum C fails, the folks up in Denver will be forced to cut another estimated $365 million next year from things like education, health care and roads – things we hold near and dear. Vote yes on Referendum C. Referendum D What is proposes: Based upon whether Referendum C passes, this would allow the state to borrow up to $2.07 billion against that expected revenue to immediately start work on road and schools. Specifies that the money shall be used for transportation projects, K-12 and higher education capital construction, and funding of pensions for police and firefighters. Pros: The state’s road budget lost nearly 40 percent of its state funding between 2001-04. Meanwhile, the state reports that 39 percent of its highways are in poor shape with 29 percent requiring replacement. Furthermore, that state has yet to make good on a pledge of $147 million to fix run-down schools and has not made payments to state firefighter and police pensions over the lat two years. Referendum D specifically addresses these long-term financial needs and pressing projects while managing its financial resources. Cons: Referendum D is a sales hook to make voters believe their money is for specific projects. Since it is not a constitutional amendment, Referendum D can be changed at any time with a vote from the Legislature. Referendum D is simply more weight added to the already bloated and inefficient budget, and it will negatively impact the economy. Where we stand: See above, and vote yes on Referendum D, too. Regional Housing Authority Referred Measure 1A What is proposes: Another de-Brucing measure to allow the newly created housing authority to exempt itself from certain TABOR limitations, which it is subject to as a public entity that establishes its own budget. According to Housing Authority Executive Director Forrest Neuerberg, under TABOR, the authority must specifically outline what its budget will be spent on before approval. However, as Neuerberg points out, many development opportunities are unknown at the time the budget is being drawn up. “This will help cover development projects that don’t come up during the budgetary process. The idea is to give the housing authority flexibility to do what it does, which is the business of developing housing.” The measure would also allow the housing authority to extend debts or obligations beyond one fiscal year, which is important since most projects take longer than this. The measure does not involve a tax increase or taxing authority. Pros: Those in favor say the measure will allow the authority to do its job, something which would be severely hindered by TABOR. Cons: No formal opposition or controversy. Where we stand: It’s about time La Plata County got on the affordable housing bus, now it’s time to get that bus rolling. Vote yes on Referred Measure 1A. Durango School District 9-R Transportation Override What it proposes: Speaking of buses, over the last five years, the cost of transporting students has risen significantly while district revenues have stayed flat. For school year 2005-06, the problem is likely to continue, with fuel costs expected to rise another $100,000 while the district sees an increase of only $57,000 in its general fund. Currently, state funding reimburses 20 percent of the district’s annual transportation bill of $792,000. The transportation override would increase property mill levies slightly, amounting to $5.41 a year for a home valued at $300,000 (not 45 cents a year as previously reported). The override would bring in about $415,000 in its first year and would not go over $550,000 per year. Pros: Those in favor say the override really isn’t about buses – it’s about protecting our children’s education. In other words, creating this revenue will allow the district to free up money for other things, like reading, writing and ’rithmetic. Cons: Again, no formalized opposition has emerged although we imagine there may be an objective old-timer or two out there who had to walk to school, uphill, both ways. Where we stand: Isn’t it hard enough to get kids to school without making them walk? Vote yes on the 9-R transportation override.

|